This is the fourth of a six-part series on how the proposed lease accounting rules will impact six major market segments in the leasing industry. This segment focuses on large-ticket transactions. Municipal, IT/office equipment and vehicles were covered previously, although readers from those segments should read on as Bill Bosco includes new information regarding recent FASB/IASB decisions in the lessee and lessor summaries below. Future segments will cover construction/materials handling and medical.

Summary of the Proposed Changes (Per the Exposure Draft Issued 8/17/10)

Lessee

Where we are now (although still subject to change) is that all operating leases will be capitalized as an asset [the right of use (ROU) of the leased asset] and a liability (capitalized lease obligation) measured by the present value of the estimated lease payments based on the current GAAP definition of the lease term (a major favorable change versus what was proposed in the ED). They are still trying to finish and issue the rule this year, but it is unlikely to be issued until the first or second quarter of 2012. They are likely to issue a new ED for public comment and I urge all readers to comment. It is easy to comment as all you have to do is write an e-mail to director@fasb.org. All comments received constitute part of the FASB?s public file. The FASB will make all comments publicly available by posting them to its website and by making them available in its public reference room in Norwalk, CT. They have moved the expected effective date to 2015 (the delayed implementation is good news). I personally think they will hold that effective date.

Variable payments based on an index or a rate (like LIBOR) must be estimated and included in minimum lease payments. Variable payments based on usage like cost per use or excess mileage charges will only be considered a minimum lease payment if they are considered to be ?disguised? minimum lease payments (where the contractual rents are below market and the contingent rents are sure to occur and make up the difference). If the lease payment includes service/executory cost elements as in a bundled full-service lease, the lessee and lessor must separate the executory costs from the lease payment, but if the lessee has no observable market information to estimate the breakdown, it would have to capitalize the whole bundled payment. I hope they will also allow reasonable estimates to be used to bifurcate the service elements. The lessee will consider the lease term to be the contractual lease term plus renewals where the lessee has a ?clear economic incentive? to exercise the options (in other words, very much the same as current GAAP).

Minimum lease payments will include interim rent payments, contractual payments, bargain or compelling renewal payments, estimated payments under residual guarantees (the amount by which the residual guarantee is in the money) and estimated contingent rent payments, as explained above, occurring during the estimated lease term. Purchase options will be ignored unless they are bargains (in which case the lease is considered a loan/capital lease). Lessees will use their incremental borrowing rate or the implicit rate in the lease, if known, to calculate the PV of the payments to determine the amount to capitalize. Lessees have to review and adjust estimated variable payments and the lease term estimate whenever they report financial results and use the original incremental borrowing rate to calculate any adjustment. However, if the estimated lease term changes, the incremental borrowing rate will also have to be changed to reflect the revised term.

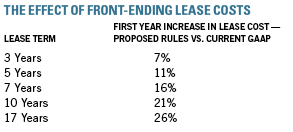

If the lease is a floating rate lease, the spot LIBOR rate is used to estimate the payments, but details on how to calculate subsequent accounting and adjustments when rates change have not been determined. Leases of 12-month terms or less and have no renewal options will be accounted for under the current operating lease method. The P&L lease cost will be comprised of a straight-line amortization of the ROU asset and imputed interest on the liability. This front ends lease costs for lessees. This is a recent change as the boards had proposed using straight line rent expense for what is now considered an operating lease based on the average rent, but the boards reversed that decision. This is very bad news for the large-ticket market as lease terms are typically long. The longer the lease term, the greater the difference between current GAAP rent expense and the proposed front-ended expense pattern.

Lessor

Lessor accounting is still under discussion. The ED proposed three accounting methods for equipment lessors (Derecognition, Performance Obligation and Operating Lease) but the FASB/IASB boards now are considering dropping the Performance Obligation (PO) method. Both boards favor using the operating lease method to account for leases with a term of 12 months or less. The current view of the IASB is that leases of an entire asset (as opposed to a lease of a part of an asset like office space in a building) should use a Derecognition method similar to direct finance lease accounting under current GAAP. Under this method, a PV receivable and a ?plugged? residual would be recorded. The residual asset would be accreted. The rate used to discount the rents and accrete the residual would be the implicit rate in the lease.

The FASB favors two lessor methods ? a Derecognition method (as above) and an Operating Lease-like method based on risks and rewards based classification criteria similar to those in IAS 17. The FASB?s Operating Lease-like method would leave the leased asset on books but book a receivable and an offsetting deferred income account. The deferred income account would be amortized at the same rate as rents are received.

Lessors are also required to estimate lease payments in the same manner as lessees. It is difficult to report on status of the lessor methods as less has been decided since the focus of the project is on getting operating leases capitalized by lessees. The boards are taking up lessor accounting now. They have said that they want to use concepts being developed by the revenue recognition project to guide lessor accounting. This is likely to mean that where the lessee controls the right to use the asset, the lessor will derecognize the value transferred in the form of booking the PV of the rents and residual and derecognizing the leased asset. Lease revenue will be finance income as the rents are collected and the residual is accreted (although the ED proposed to not allow residual accretion, there are indications that they will reverse that decision).

It is not logical to have a lessee capitalize payments yet not allow a lessor to record a receivable using a Derecognition model. It would also be bad news for the industry to still have an operating lease model or PO model for other than short-term leases, but being bad news for the industry is not a good excuse that the FASB would accept.

Sales-type lease accounting for gross profits of manufacturers/dealers is still under discussion. The likely outcome under the proposed Derecognition method is that the portion of the gross profit related to the residual will be deferred until the asset is sold or re-leased. Under the FASB?s Operating Lease-like method there would be no up front sales-type profit recognized.

Leveraged lease accounting is a U.S.-only issue and is likely to be eliminated. It is also unlikely that existing leveraged leases will be grandfathered. There is some outside hope that they will allow netting of debt under a separate project called ?Balance Sheet ? Offsetting,? but as it stands they will not include leveraged leases in the scope. The boards will not allow the ?MISF? yield or a tax-affected yield to be used for revenue recognition. This of course is a topic that readers in the large-ticket segment should comment on to the boards. Time is of the essence, as it is on their table now.

Focus on the Large-Ticket Business(There is not much good news here for the large-ticket segment)

Impact to Lessees

- All but short-term leases will be capitalized. The amount capitalized should be less than the equipment cost in the case of true leases based on the tax benefits transferred in the form of tax affected rents. The bigger the PV benefit, the lower the amount capitalized.

- The P&L cost pattern will be front ended and will not be called rent expense. Rent expense will be replaced by straight line amortization of the ROU asset and imputed interest on the lease obligation. The front-ended pattern will cause lessees to book deferred tax assets as book expenses reported will exceed the tax deductions for rent in the early years of the lease. It is a timing difference that will turn around in the later years of the lease term. The front-ending effect will be greater the longer the lease term, as illustrated below.

- As strange as it may seem, EBITDA for lessees will improve as rent will not be considered a negative operating cash outflow.

Impact to Lessors

- Leveraged leases will be grossed up requiring more capital to be allocated unless we get relief under the ?Balance Sheet ? Offsetting? project. The revenue recognized will be based on the pre-tax yield in the lease, not the tax affected yield. Alternatives like partnership structures will still allow reporting of only the net investment in the partnership, although those structures are less efficient than leveraged leases. Partnership structure revenue recognition also does not allow for an MISF-like revenue pattern.

- The synthetic leases should be classified as Derecognition method leases. A PV lease receivable and residual will be booked. The residual guarantee is not considered a minimum lease payment as per current GAAP. There will be no need to buy residual insurance, as they should not be treated as Operating Leases.

- For manufacturers/captives it is likely that only partial sales-type lease profit will be recognized up front. Gains on sale will be recognized based on the portion of the value of the right of use transferred in the lease. The value of the right of use is the PV of the rents; so, if the rents PV to 79% of fair value of the leased asset, then 79% of the gross profit will be recognized. The gross profit attributed to the residual will be deferred and recognized when the asset is sold or re-leased.

- The FMV leases should also be Derecognition leases, but it will be a judgment call and the higher the residual the greater the risk that they will continue to be treated using the operating lease-like method favored by the FASB. The industry does not agree with using IAS 17-like criteria for lessor lease classification, and we will continue to fight it.

Where Might We Be In The End?

What I reported above is still subject to change. I predict that the IASB view will prevail, so we will most likely see the end of Operating Lease accounting and the related negative issues. This is a minor victory. The loss of leveraged lease treatment will be a big blow to the industry as balance sheets will be inflated and earnings recognition patterns will flatten and the cost of leasing for lessees will increase. I have to say it loud and clear that only a concerted effort via comment letters and private meetings with the FASB will save some form of leveraged lease accounting. It is all up to you.

Note: Most of what is proposed in the Exposure Draft (ED) issued by the FASB/IASB boards has and will change as the boards received significant negative comments in their outreach activities and in the more than 780 comment letters received on the Leases project ED. It should be noted that the FASB did not receive much feedback from the large-ticket community, so they are proceeding without good information, which is dangerous for the industry.

Bill Bosco is president of Leasing 101, a lease consulting and training company. He has more than 35 years experience in the leasing industry, with expertise in accounting, tax, structuring and pricing. He has product development and strategic marketing experience as well. He has been on the ELA accounting committee since 1988 and was chairman for ten years. Bosco was selected by the FASB/IASB to be a member of the Lease Accounting Project Working Group. He can be reached at 914-522-3233, or by e-mail at wbleasing101@aol.com. For more information on the company, visit www.leasing-101.com.

Bill Bosco is president of Leasing 101, a lease consulting and training company. He has more than 35 years experience in the leasing industry, with expertise in accounting, tax, structuring and pricing. He has product development and strategic marketing experience as well. He has been on the ELA accounting committee since 1988 and was chairman for ten years. Bosco was selected by the FASB/IASB to be a member of the Lease Accounting Project Working Group. He can be reached at 914-522-3233, or by e-mail at wbleasing101@aol.com. For more information on the company, visit www.leasing-101.com.Source: http://www.monitordaily.com/proposed-lease-accounting-rules-change-business/

deviantart superman man of steel superman man of steel harry potter and the half blood prince avon oil price oil price

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.